MARKET NEWS

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

Liontrust loses McLoughlin

Head of trading Matthew McLoughlin has resigned from Liontrust Asset Management.

McLoughlin has been a partner and head of trading at the active investment management...

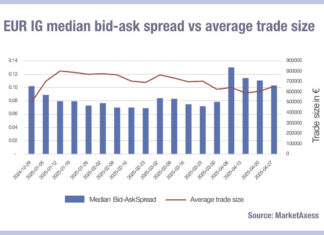

MarketAxess holds US credit trading high ground in April volatility

A burst of spread widening and credit ETF related trading pushed US electronic credit trading to another record in April.

TRACE volumes for investment grade...

Bloomberg broadens EM bond pricing coverage

Bloomberg has expanded its intraday valuation (IBVAL) front office service to cover emerging market (EM) bonds on a 22/5 basis.

Launched in 2023, IBVAL provides...

ICE Bonds builds on corporate bond volume records

ICE Bonds has introduced price improvement volume clearing (PIVC) to its risk matching auction (RMA) corporate bonds protocol.

RMA executes dealer-to-dealer sweep auctions, matching buyers...

FEATURES

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

PROFILES

RESEARCH

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

FROM THE ARCHIVES

Tradeweb expands mortgage trading platform to originators

Fixed income market operator, Tradeweb, has expanded its platform for trading specified pools of mortgages, now enabling mortgage originators to trade alongside other secondary...

FILS US 2023: Trading protocols urgently need to evolve, says All-Star Panel

Panelists speaking on the All-star Protocol Predictions Panel in Nashville this week agreed that, love it or hate it, the request for quote (RFQ)...

Europe’s liquidity rules are holding up… for now

New guidance on fund liquidity has followed redemption concerns in European equity and bond funds, writes Lynn Strongin-Dodds.

The risk that funds are unable to...

David Blake leaves Northern Trust as director for Global Fixed Income

David Blake has left Northern Trust Global Investments as director for Global Fixed Income, after 15 years at the firm, following a restructuring of...

Morgan Stanley: Portfolio trading volumes have grown by 56% in 2020

Research by Morgan Stanley’s market strategist team has found that use of portfolio trading in the US corporate bond market has increased by 56%...

BNP Paribas issues first Eurozone sovereign digital bond

BNP Paribas has arranged and placed the first sovereign digital bond issuance for Eurozone and EMEA in the Republic of Slovenia.

The digital securities coupon...

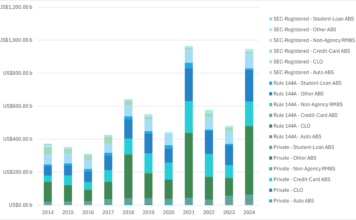

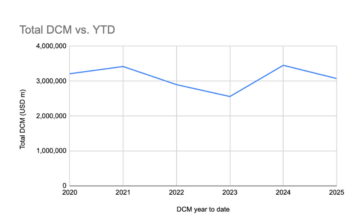

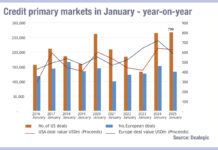

Retreat in credit market primary activity in January 2025, Munis a bright spot

In January 2025, Debt Capital Markets (DCM) for credit issuance retreated in the US and in Europe while primary activity for municipal bonds (Munis)...

Control is the best defence

By Chris Roberts | 29 May 2024

With a growing level of scrutiny coming from European Regulatory bodies about the quality of data reporting, firms...

ICE freezes bond indices until 30th April

The Intercontinental Exchange’s (ICE’s) ICE Data Indices (IDI) has postponed the rebalancing of all the ICE and ICE BofA indices for bond, preferred and...

‘Resurgence’ in fixed income in 2023 drove e-trading in December

Electronic trading platforms saw a big boost to trading volumes in December, finishing off a great year for fixed income.

Tradeweb

Tradeweb Markets has reported a...

FILS 2022: FlexTrade, Glimpse herald “transformative” EMS data integration

Bond market data sharing platform Glimpse Markets has integrated with FlexTrade Systems’ fixed income execution management system (EMS), the two companies have announced.

FlexTrade said...

Tradeweb confirms purchase of Australian bond trading platform Yieldbroker

Multi-asset market operator, Tradeweb Markets has entered into a definitive agreement to acquire Yieldbroker, an Australian trading platform for Australian and New Zealand government...